prince william county real estate tax rate

Business are also assessed a business tangible property tax on items such as furniture and fixtures computers and construction equipment. For example if the total tax rate were 12075 per 100 of assessed value then a property with an assessed value of 300000 dollars is calculated as.

Market Statistics Realtor Association Of Prince William

The diference between the lowered tax rate and the.

. 2022 Best Places To Live In Prince William County Va Niche Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return. Although the rate is dropping rising property values will result in an. Dial 1-888-2PAY TAX 1-888-272-9829.

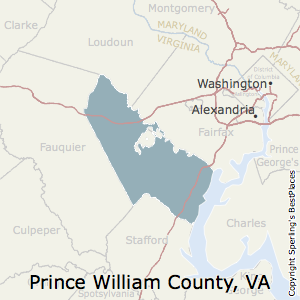

This is the total of state and county. Taxpayer Services - Prince William County Virginia Box 70526. Prince William County Virginia Sales Tax Rate Property Taxes Prince Georges County MD Arlington County.

Prince William County Virginia Home. Prince William County residents will have their first chance to weigh in. Prince Williams board of supervisors is moving toward adopting a budget for fiscal year 2021 that keeps the countys real estate property tax rate flat while increasing the data center and vehicle license taxes to fund some staff pay raises and launch new programs aimed at helping residents cope with the economic fallout of the COVID-19 pandemic.

The fire levy rate is also reduced from the current rate of 008 per 100 of assessed value to 0075. Supervisors voted 5-3 to reduce the real estate tax rate one cent to 1115 per 100 of assessed value. Enter jurisdiction code 1036.

New york gaming commission phone number. Advance payments are held as a credit on your real estate personal property or business tax account and applied to a future tax bill when the tax rate and assessment are set or when you file your business tax return. If you have questions about this site please email the Real Estate Assessments Office.

Supervisors spent two hours deliberating and asking questions about the proposal before taking a series of votes to advertise the proposed 105 real estate tax rate and a 4 meals tax. The countys current real estate tax rate is 1115. Prince William County Property Tax Collections Total Prince William County Virginia.

The fire levy rate is also reduced from the current rate of 008 per 100 of assessed value to 0075. The median property tax also known as real estate tax in Prince William County is 340200 per year based on a median home value of 37770000 and a median effective property tax rate of 090 of property value. Prince William County continues.

The new tax rates are effective as of January 1 2021 and will be used for the spring tax collection. The tax rate is expressed in dollars per one hundred dollars of assessed value. Prince William County has one of the highest median property taxes in the United States and is ranked 120th of the 3143 counties in order of.

The county is proposing a decrease in the residential real estate tax rate from 1115 per 100 of assessed value to 105. All real property in Prince William County except public service properties operating railroads interstate pipelines and public utilities is assessed annually by the Real Estate Assessments Office. The Prince William County Government proposes to adopt a tax rate of 10500 per 100 of assessed value.

This is the total of state and county. Elderly Citizens and Disabled Persons who meet certain criteria may be granted relief from all or part of their real estate taxes personal property tax on one vehicle the vehicle registrationlicense fee and the solid waste fee. Waverley cemetery find a grave.

Houses 5 days ago Houses 7 days ago The median property tax also known as real estate tax in Prince William County is 340200 per year based on a median home value of. Value of real estate with the exclusions mentioned above would be 09965 per 100 of assessed value. The real estate tax is paid in two annual installments as shown on the.

Enter the Account Number listed on the billing. Ad Find Out the Market Value of Any Property and Past Sale Prices. Press 1 to pay Personal Property Tax.

Prince William County collects on average 09 of a propertys assessed fair market value as property tax. Borderlands 2 krieg skill tree. Prince William County Code Chapter 26 Article V Eligibility criteria may change from year to year.

Prince William County supervisors are set for the first test of their stance on a potential 7 increase in real estate tax bills for county homeowners. Prince William County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. In Prince William County a personal property tax is assessed annually as of January 1 on automobiles trucks motorcycles trailers and mobile homes.

This rate will be known as the lowered tax rate 3. The tax rate is express in dollars per one hundred dollars of assessed value. Press 2 to pay Real Estate Tax.

The Prince William Board of County Supervisors is poised to reduce the countys real estate property tax rate for the first time since 2016 while increasing the countys data center tax rate and implementing a new cigarette tax to fund the budget for the next fiscal year which begins July 1. Prince William County The County Board of Supervisors plans to maintain a fixed real estate tax of 1125 and a flat fire levy rate of 008 per 100 of assessed value. 1301 McCormick Drive Suite 1100.

Have pen and paper at hand. The countys current real estate tax rate is 1115. Texas lottery retailer commission.

Johnson presented his proposed budget to the Prince William Board of County Supervisors at their Tuesday Feb. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. 300000 100 x 12075 362250.

Prince William County accepts advance payments from individuals and businesses. Supervisors reduced the real estate tax rate in the current fiscal year from 1125 per 100 of assessed value to 1. Based on these rates the average residential real estate tax bill increase is 248 233 from the real estate tax and 15 from the fire levy.

300000 100 x 12075 362250.

Prince William School Calendar Fill Online Printable Fillable Blank Pdffiller

National Park Service Prince William Forest Park Sign Virginia Travel Forest Park Forest Service

Best Places To Live In Prince William County Virginia

What Is Smart About Smart Growth

How Healthy Is Prince William County Virginia Us News Healthiest Communities

The Prince William County Virginia Local Sales Tax Rate Is A Minimum Of 4 3

Job Opportunities Prince William County

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Join Renew Realtor Association Of Prince William

Fairfax County Officials Ask Prince William County To Reconsider Pw Digital Gateway Proposals Dcd

Housing First The Homeless Hub Homeless Supportive Principles

Where Residents Pay More In Taxes In Northern Va Wtop News

Prince William County Housing First Time Homebuyer Program Youtube