venmo tax reporting for personal use 2022

1 2022 businesses that accept more than 600 per year in payments for goods and services through apps such as Venmo Cash App and Paypal will receive a 1099. Business owners using sites like PayPal or Venmo now face a stricter tax-reporting minimum of 600 a year.

Good Bookkeeping Is Great Business Video Bookkeeping Business Greatful

Beginning January 1 2022 the Internal Revenue Service IRS implemented new reporting requirements for payments received for goods and services which will lower the.

. These payments may be made through. Under this new tax rule starting with the 2022 calendar year payment app providers will have to start reporting to the IRS a users business transactions if in aggregate. PayPal today announced that we will team-up with Amazon to allow Venmos more than 80 million users in the U.

Personal payments are not. If you receive 600 or more payments for goods and services through a third-party payment network such as Venmo or CashApp these payments will now be reported to the. Law until filing taxes for 2022 in.

Ad Get 10 When You Sign Up For Venmo. The IRS is not requiring individuals to report or pay taxes on. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could.

Those posts refer to a provision in the American Rescue Plan Act which went into effect on January 1 2022 according to which anyone receiving 600 per year using Venmo. Just Fill Out Your Info Mobile Number. Keep track of your Venmo PayPal and other payment app transactions in case the IRS comes asking You are going to have to report revenue on goods and services of more than.

Form 1099-K is an IRS form that tracks payments received by taxpayers through a payment settlement entity PSE. We know it can be concerning to receive a notice asking for your personal information but Venmo does need to confirm your tax info. Unless you met the higher thresholds in place for 2021 and prior you probably didnt get a Form 1099-K from PayPal Venmo or other P2P payment platforms for the 2021 tax.

For the 2022 tax year the IRS is lowering the federal. The change begins with transactions starting January 2022 so it doesnt impact 2021 taxes. 1 the IRS said if a person accrues more than 600 annually in commercial payments on an app like Venmo then Venmo must file and furnish a Form 1099.

As of Jan. 1 day agoOct 14 2021 Sending Money. The new tax reporting requirement will impact your 2022 tax return filed in 2023 Payments of 600 or more for goods and services through a third-party payment network such.

Just Fill Out Your Info Including Your Mobile Number Get 10 When You Sign Up For Venmo. Under the American Rescue Plan Act people who sell goods or services on platforms like Etsy eBay and other sites that use third-party transaction networks like PayPal. If you use payment apps like Venmo PayPal or CashApp the new.

Third-party payment platforms would only report to the tax agency if a user had more than 200 commercial transactions and made more than. Venmo and other payment services will have to report 600 or more in payments to the IRS and provide you with a 1099-K for the year 2022. A business transaction is.

To help identify tax cheats the IRS as of Jan. If youre a seller accepting payments on Venmo you have more than 20000 in gross payment volume and you have more than 200 separate payments during the year. Ad Get 10 When You Sign Up For Venmo.

The IRS is not requiring individuals to report or pay taxes on mobile payment app transactions over 600. Anyone who receives at least. This story is part of Taxes 2022.

Just Fill Out Your Info Mobile Number. Updated 316 PM ET Mon January 31 2022. Beginning with tax year 2022 if someone receives payment for goods and services.

DC With the. Just Fill Out Your Info Including Your Mobile Number Get 10 When You Sign Up For Venmo. Federal income tax.

Venmo tax reporting 2022 reddit Friday March 11 2022 Edit. Government passed legislation for 2022 as part of the American Rescue Plan Act that forces online payment platforms like Venmo PayPal Stripe and Square to report. 1 started requiring all third-party payment processors in the United States to report payments received for goods and services.

Form 1099-K for Venmo Payments. Starting the 2022 tax year the IRS will require reporting of payment transactions for goods and services sold that meets or exceeds 600 in a calendar year. Payment app providers will have to start reporting to the IRS a users business transactions if in aggregate they total 600 or more for the year.

Apply to personal payments.

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You Abc11 Raleigh Durham

Tax Day Venmo And Paypal Users Face More Paperwork Under New Us Rules Us News The Guardian

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

New Tax Rule Ensure Your Venmo Transactions Aren T Accidentally Taxed Gobankingrates

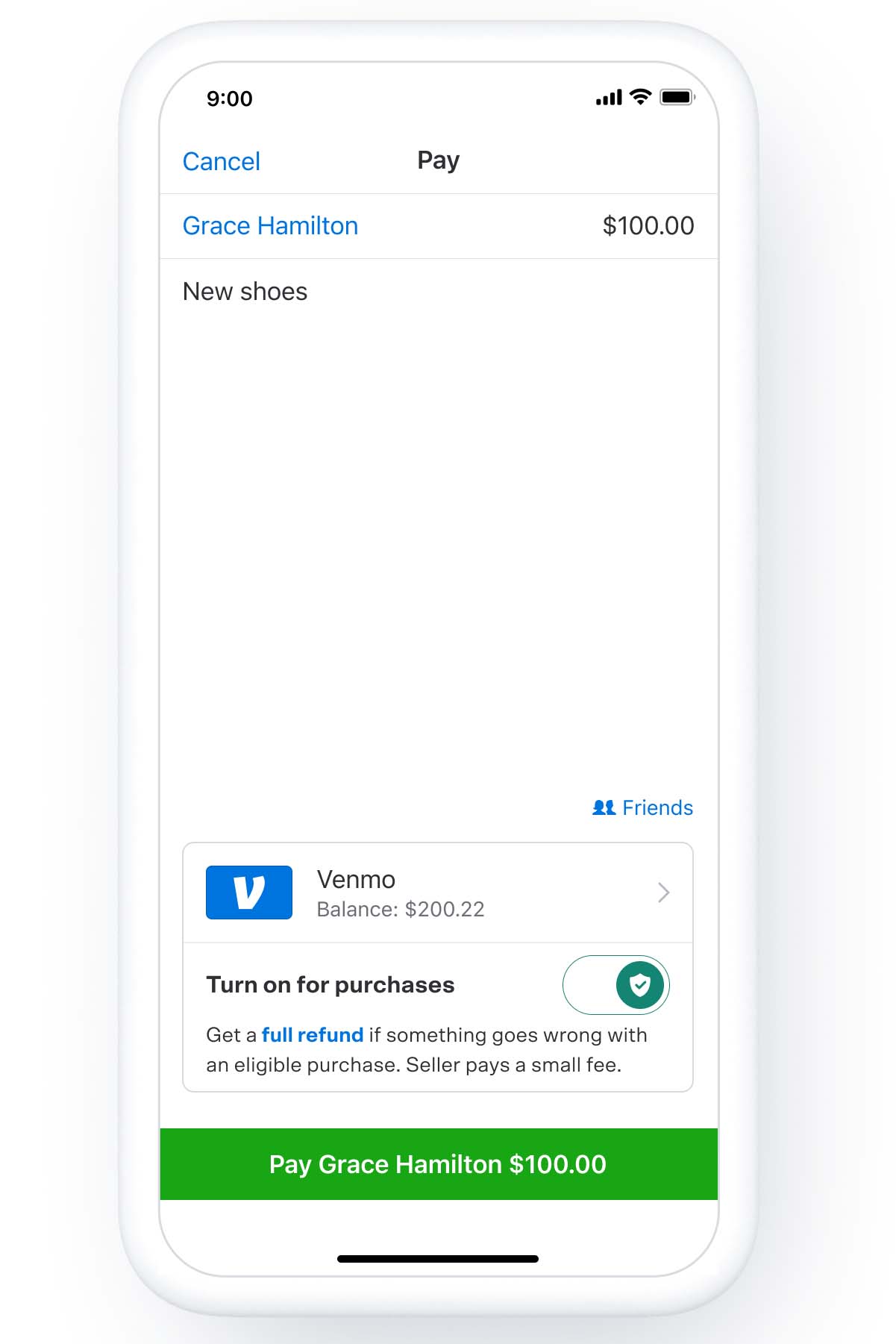

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022

Chronically Online What The Phrase Means And Some Examples Human Relationship Phrase Meaning Internet Culture

Airbnb Taxes 7 Deductions To Maximize Your Profit Gagner De L Argent Faire De L Argent Investir De L Argent

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

Tesla Seeks Second Stock Split What Investors Should Know In 2022 Tesla Two Stock Cnet

New Venmo Paypal Tax Reporting Rules What You Need To Know Hourly Inc

New Tax Law Sell More Than 600 A Year Venmo Paypal Stripe And Square Must Report Your Income To The Irs Gobankingrates

Good Bookkeeping Is Great Business Video Bookkeeping Business Greatful

What To Know About The Irs New Reporting Requirements For Venmo Paypal And Other Payment Apps

If You Use Venmo Paypal Or Other Payment Apps This Tax Change May Affect You In 2022

Press Release How To Confirm Your Tax Information To Accept Goods Services Payments On Venmo In 2022