carried interest tax changes

The Implications for Investment Advisors. At most private equity firms and hedge.

Free Printable Personal Tax Checklist Filing Taxes Tax Checklist Tax Prep Checklist

Any ability for a service provider to receive LTCG rates from a.

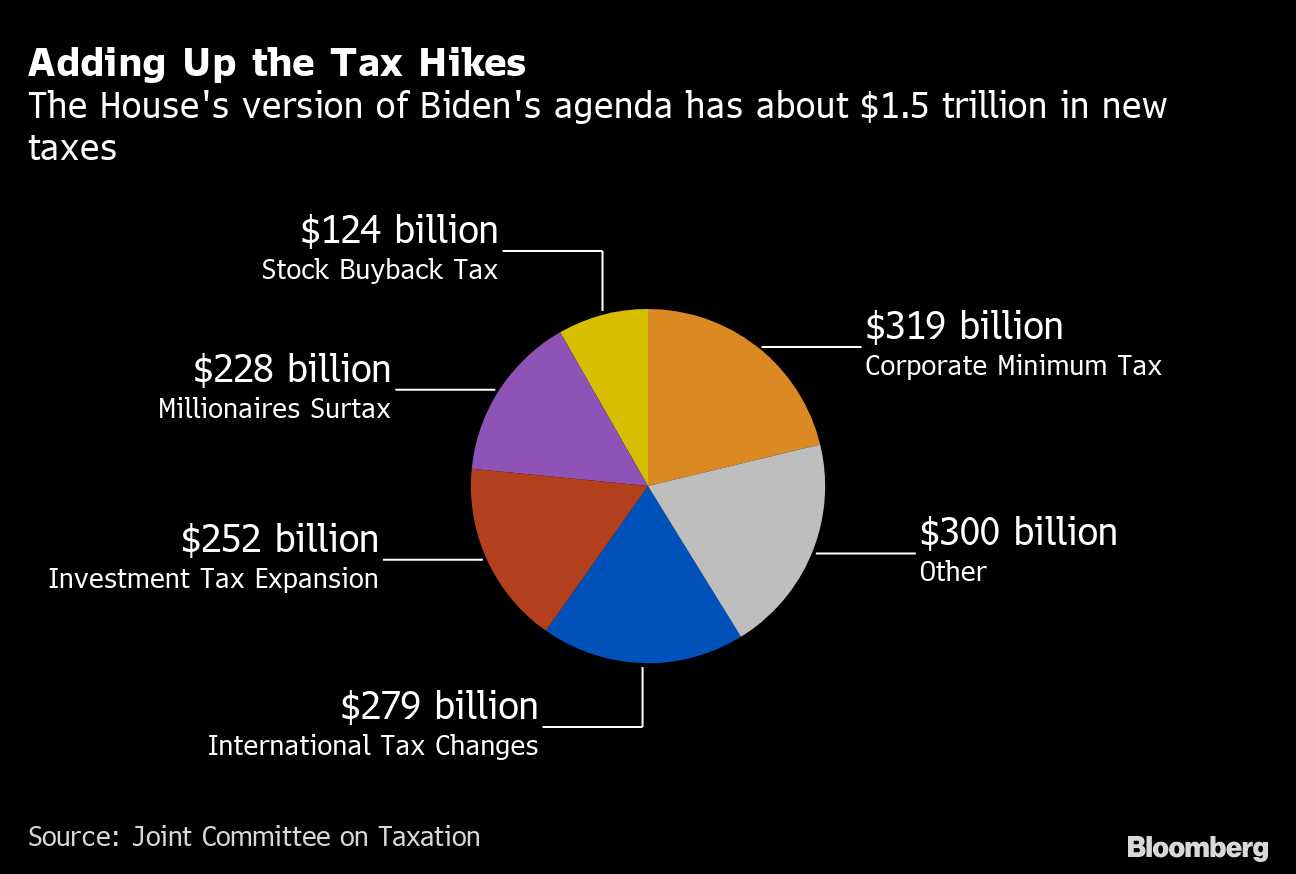

. WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White. Lawmakers said that the Joint Committee on Taxation has estimated that over the 10-year budget window the Bill would generate 313 billion from the new corporate book. Under the 2022 IRA if one or more applicable partnership interests are held by a taxpayer at any time during a taxable year the.

The significant tax changes to the treatment of carried interest introduced in this bill track the mark-up of the Build Back Better Act that came out of the House Committee on. A report by the accounting firm KPMG on the American Jobs and Closing Tax Loopholes Act which passed the Democratic-controlled House in 2010 and applied tax. Dropping the carried interest tax provision from the Inflation Reduction Act cost 14 billion in projected revenue but Schumer made up for it by adding an excise tax on stock.

The bill directs the Treasury Department to issue regulations to prevent the avoidance of short-term capital gain treatment under Section 1061 and specifically mentions. Carried interest rule changes could have a negative affect on the venture industrys inclusion. 2022 IRA proposed changes to carried interest taxation.

The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains. If enacted into law the Inflation. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead. Tax increase on carried-interest income could potentially hurt small businesses and big investors. The carried interest provisions if now adopted are proposed to be effective for taxable years beginning after December 31 2022.

Managers with a holding period of less than five years would incur short-term capital gains tax rates on carried interest a 37 top rate the same that applies to wage and. The Inflation Reduction Act of 2022 IRA has taken a step forward as the Senate completed its deliberation and passed the bill on August 7. Private equity and hedge funds cautioned on Thursday that a proposed US.

The proposed amendments would be effective for tax years beginning after December 31 2022. Transfers of carried interest would be subject to tax at short-term capital gain rates even if a non-recognition provision would otherwise apply. The Tax Cuts and Jobs Act.

While in the Senate a few. Congress has indicated that it desires to change the law to further close the carried interest loophole ie. The proposed change in.

In his must-read new book Post Corona Scott Galloway calls Section 1202 a.

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Carried Interest Changes In The Inflation Reduction Act Of 2022 Blogs Foley Funds Legal Focus Foley Lardner Llp

Uk Tax Tips For Artists Art Business Info For Artists Tax Tips Artist

Nigeria S Debt Rises By N2 54tn In Three Months Hits N38tn Says Dmo Guides To Everything African Development Bank Debt Management Nigeria

Carried Interest In Venture Capital Angellist Venture

Sen Kyrsten Sinema Agreed To The Inflation Reduction Act But Cut The Carried Interest Tax Provision Here S What That Means For Wealthy Investors

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

What Are Deferred Tax Assets And Deferred Tax Liabilities Article

What Closing The Carried Interest Loophole Means For The Senate Climate Bill Npr

Internal Auditors Must Consider Different Aspects Of A Business Business Performance Success Business Accounting And Finance

Venture Investors Shrug At Proposed Changes To Us Carried Interest Taxation Techcrunch

Carried Interest The Tax Loophole That Won T Die The New York Times

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

Deferred Tax Asset What It Is And How To Calculate And Use It With Examples

Rich Wall Streeters Face Shock Tax Hike Thanks To Manchin Schumer Deal Bloomberg

How Does Carried Interest Work Napkin Finance

How Does Carried Interest Work Napkin Finance

State Taxes On Capital Gains Center On Budget And Policy Priorities